Amazon MGM Studios Casts Star-Studded Ensemble for Romantic Comedy You Deserve Each Other

EXCLUSIVE: Big casting news for the upcoming Amazon MGM Studios feature adaptation of Sarah Hogle’s bestselling novel You Deserve Each Other. Joining already cast stars Penn Badgley and Meghann Fahy are Natalie Morales, Justin Long, Kyle MacLachlan, Ana Gasteyer, Timothy Busfield, Hope Davis, Delaney Rowe, Lisa Gilroy, and Alyssa Limperis.

Billed as a lovers-to-enemies-to-lovers romantic comedy, You Deserve Each Other follows Naomi Westfield, who has the perfect fiancé, Nicholas Rose—considerate, from an upstanding family, and seemingly ideal. But Naomi is utterly sick of him. The catch? Ending the engagement means footing a hefty nonrefundable wedding bill.

When Naomi discovers Nicholas is also pretending to be content, the couple engage in a battle of pranks, sabotage, and emotional warfare. As the wedding countdown looms, they unexpectedly rediscover themselves—and each other.

Directors Marc Silverstein and Abby Kohn, known for romantic comedies like Never Been Kissed and He’s Just Not That Into You, helm the film. The screenplay was revised by Silverstein and Kohn, with a first draft by Brett Haley and Marc Basch. Production is led by Fifth Season, alongside Anthony Bregman and Peter Cron of Likely Story, with Caroline Jaczko as Executive Producer.

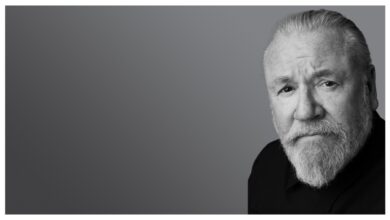

Natalie Morales plays Cassie. Known for Grey’s Anatomy and No Hard Feelings, Morales is represented by CAA and Bleecker Street Entertainment. Justin Long portrays Austin Frazier, with credits including Barbarian and Live Free or Die Hard. Kyle MacLachlan, from Prime Video’s Fallout and Twin Peaks, plays Eugene Rose.

See More ...

Ana Gasteyer, the SNL alum and star of Mean Girls and AppleTV+’s Loot, plays Deborah Rose. Timothy Busfield (West Wing, Thirtysomething) is Bernie Duncan, and Hope Davis (Succession, Asteroid City) stars as Kathy Duncan. Delaney Rowe plays Wren, Lisa Gilroy is Wendy Duncan, and Alyssa Limperis portrays Sofia Frazier.

Sarah Hogle’s novel, published in 2020 by Penguin imprint G.P. Putnam’s Sons, was a two-time Goodreads Choice Awards nominee for best romance and best debut, and an Amazon Editors’ Pick for best romance.